Protect Your Improvements

With the increase in threats and real incidents, Cyber now rates one of the top enterprise risks for organisations within the energy sector. Combine this with the competitive need to "digitise", and regulatory requirements to improve Cyber risk and we have the perfect enviornment for accelerated modernisation. Energy providers are committed to transforming their antiquated, OT environments and are investing £bn's in doing so.

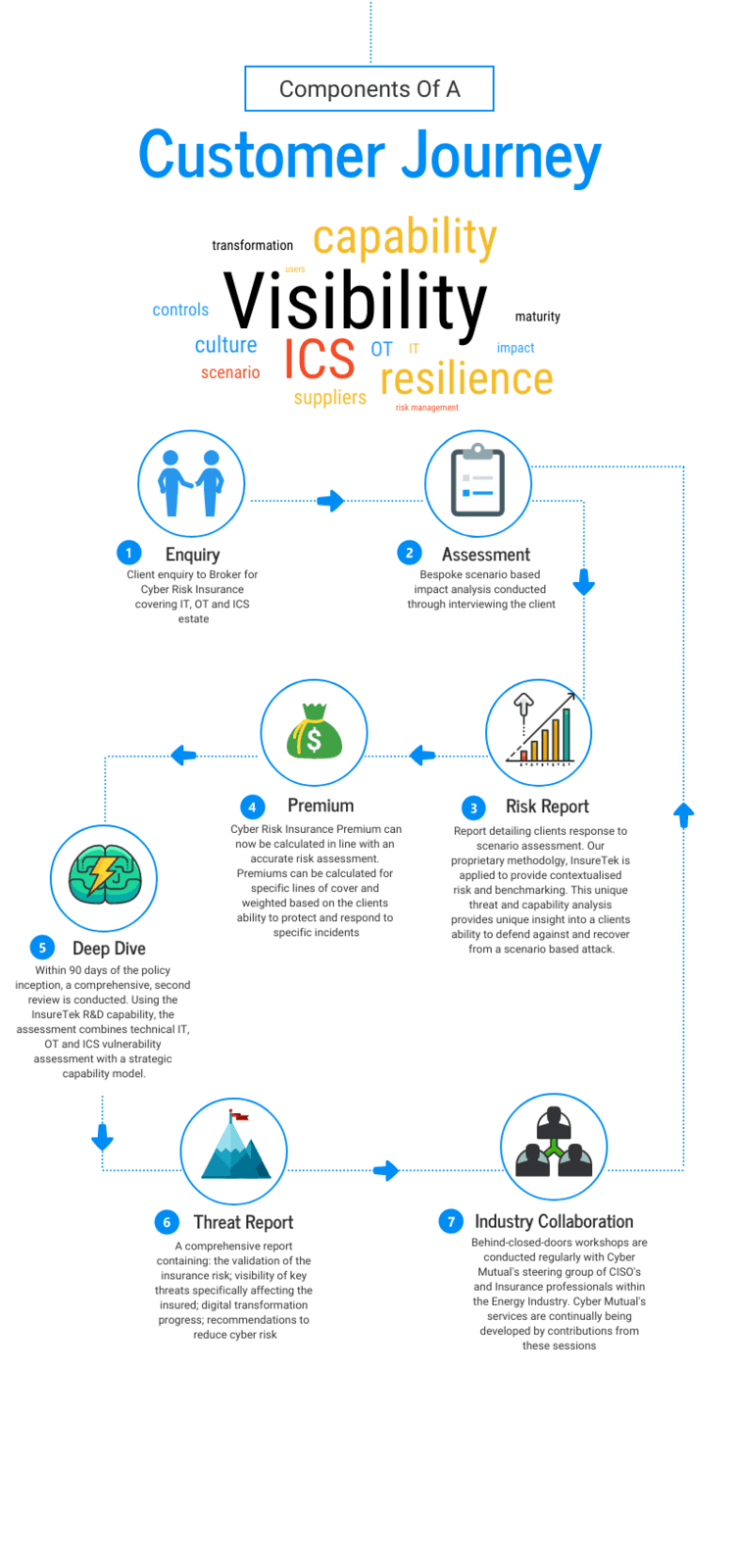

Cyber Mutual was launched specifically in the absence of a Cyber Insurance policy currently available that is able to adequately assess the Cyber risk of an energy provider during its digital transformation program, measure this risk against industry benchmarks and provide adequate insurance to protect its program investment.

Cyber Risk Assessment

Capability Assessment

- Capability Layer

- Capability Maturity

- Strategic Goals

- Future state & capability alignment

- Focused Investment

- Change Impact

Impact Assessment

- Supplier Layer

- Vulnerability Assessment

- Network Segmentation

- Operational Cyber Matrix

- Risk and Data Management

The Magic!

Cyber Mutual's proprietary risk assessment methodology blends Capability and Impact assessments to produce rich, contextualised OT, IT and IOT Cyber impact visualisations. It has been built exclusively to address the energy sectors risk profile.

Cyber Risk Insurance

Non-Physical Cyber

- Security and Privacy Liability

- Cyber Extortion

- Network Outage/Interuption

- Electronic Data

- Incident Response

- Cyber Crime

Physical Cyber

- First-Party Cyber Property Damage

- Expanded Network Outage due to Property Damage

- Cyber Operations

- General Cyber Liabilty

The Magic!

In simple terms, you decide what you want covered, in the safe knowledge that your premium is aligned to the risk and both you and your insurers have the same assessment and benchmarking information by which to make informed, risk based decisions.

You have also started a relationship with partners who wish to remove that risk from your balance sheet over the long-term.